Application & Policy

PAR Grant Application

If you are interested in applying for a PAR funds, please fill out the PAR Program Application Form. Before applying, please review the Policy and Procedures of PAR Tax Funding. If you have any questions, please contact the PAR Board at parboard@springville.org.

PAR Program Policy

PAR Grant Application

Eligibility

In order to qualify for PAR tax funds, an organization must:

- Be a 501(c)(3) nonprofit organization, or a city funded recreation, arts, or cultural program or facility.

- Qualifying 501(c)(3) nonprofit organization must:

- Have, or commit to have, a significant presence and manage/present, in Springville City; and

- Have as a primary purpose the advancement and/or preservation of natural history, art, music, theater, dance, or cultural arts.

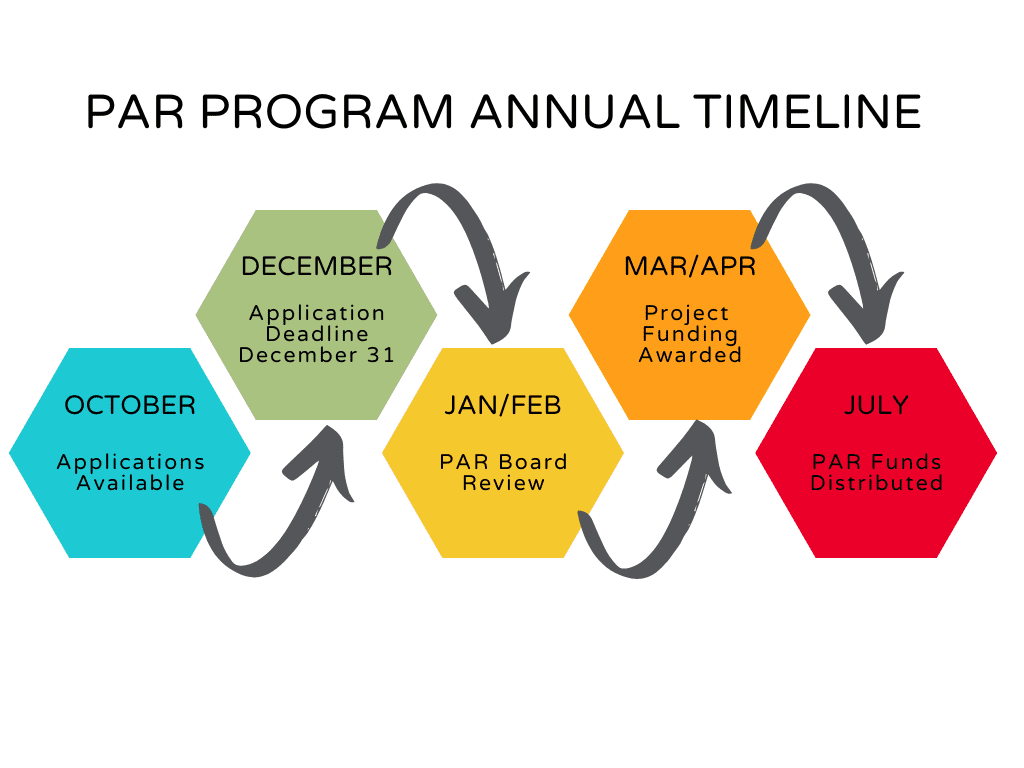

PAR Program Annual Timeline

- All requests for PAR tax funds must be submitted via application provided by the PAR Program. Applications are available each year starting October 1. The PAR Program may revise the attached application prior to making it available each year.

- All applications must be submitted prior to the application deadline. Late applications will not be considered. Applications will be received each year, October 1-December 31.

- The PAR Board will review every application, accompanying material, and shall identify and recommend which grants the City Council should approve via majority vote. Applicants may be required to make a presentation and discuss the merits of their proposals in front of the PAR Board or City Council.

- The PAR Program will provide notice to applicants regarding the PAR Board recommendations to the City Council and the City Councils final decisions on distribution of funds to be received. Those applicants who were disqualified or denied funding will also be notified.

Award Recipient Requirements

After the City Council approves the final annual PAR funding distribution list through the budget process, each organization receiving a grant shall:

- Enter into an agreement with the City prior to receiving funds and provide all required dates, documentation, and information listed in the Policy and Procedures of PAR Tax Funding.

- The required agreement must be executed by the organization receiving a grant within 60 days of the City Council approving the PAR funds.

- PAR Program funds will be disbursed in accordance with the City’s fiscal year (July 1- June 30). Distribution of funds will be at the discretion of the City. Organizations who do not expend all their grant funds shall return any unused portion of the grant to the City by June 30th of the fiscal year, unless otherwise determined by the City.

- Each organization that receives PAR Program funding shall ensure that all promotional items, programs, publications, performances and other printed materials include the PAR Program logo or other language required by the PAR Program supplied by the City.

- Provide required itemized expended funds reporting for audit in a mid-year report, and year-end report as outlined in the Policy and Procedures of PAR Tax Funding.